Seller’s Guide: What do I need to know to sell my home?

Thinking of selling your home? Wondering what the next step is in the selling process? Not sure if you are ready to sell your home yet?

This Seller’s Guide will give you the basics of each step to help you get from thinking about selling to sold.

How do I Choose a Realtor?

The first step in selling your house is choosing a Realtor. Unless of course you have a fixer-upper house and then you may want to consider selling to a wholesaler or directly to an investor if you happen to know one. You may think you don’t need a Realtor, but that is only true if you already have buyers in mind. Realtors also do so much more for you than just helping you secure a buyer. Realtors market your property, host open houses & broker’s open houses, photograph your property (or pay a professional photographer to do so), stage your home, help you pack and move, handle the contracts & negotiations, and get you from the open market to the closing table.

Trying to save money by not hiring a Realtor? In the long run, most “For Sale By Owner” (FSBO) properties do not leave the closing table with as much money as they would if they had a Realtor. Many times FSBO property owners leave money on the table by undervaluing their property. FSBO sellers hurt themselves when they fail to sell within a reasonable time because they go the other way and overprice their property and fail to market appropriately to those looking for homes.

Choices got you in a pickle?

If research and analysis aren’t helping you choose a Realtor, then go with the Realtor who makes you feel at ease and you get along with the best. This is a long journey, you want to take those you like with you and you know will have your best interests at heart through the good and bad times.

Why do Realtors cost so much?

The commission breakdown- half goes to the selling agent, half to the listing agent. So when the listing agent asks you to sign a contract for a 6% commission this is pretty standard and it is not all going to the listing agent- they share this with the buyer’s agent aka selling agent. Unless they manage to bring you a buyer as well, then they keep the full 6% commission.

Charging a commission based on a percentage of a commission is a good thing for you, the seller. They will work hard to get top dollar for your property. They will negotiate contracts to help you get the best deal possible. They are supposed to do this as their job, but the way they are paid gives them more incentive to do so.

Realtors who charge a flat fee often just want an easy way to make quick cash. They charge a $500 to $1,000 flat fee and in return, they list your property on the MLS. Often that is where they stop working for you. They do not market your property. They might take nice photographs of your property or they may ask you to take some and send them over. They will not show the property or answer questions from other agents about the property, that is all on you. Along with the negotiations, writing the contracts, and handling the closing process which includes title work, abstracting, scheduling inspections, appraisal, and surveys.

In Oklahoma, and many other states, the seller pays for both agents, however, in markets where this is what happens, the market prices account for this. All homes on the MLS in Oklahoma account for the seller’s paying the commission out of their proceeds as well as helping with the buyer’s closing costs. So really the seller isn’t “losing” money because the buyer is paying inflated prices that cover those costs, so in that respect, the buyer is paying for the agents and the closing costs with their increased mortgage.

House of Money

Realtors may only spend an hour with you so it feels like they shouldn’t get 3% of the proceeds, but the work they do is often unseen. They are working hard to make sure you get top dollar for your house. Prospecting, marketing, research & analysis, driving to properties, inspections, and many more tasks that make up a Realtor’s life often equal more than 40 hours a week- all unpaid until they get you to the closing table. You are their #1 priority, if you aren’t then you need a new agent!

What does a Realtor do for the seller?

Marketing online, social media, brochures, in magazines, and at events

Stages your house to look its best

Photographs of the property to present to the world as part of marketing

Host brokers open houses and open houses

Creates CMAs with thorough research to ensure top dollar for your property

Writes and negotiates contracts that benefit you, the seller.

Realtors do all of these things out of their pocket, upfront, to get your house sold- what other professional would do this for you? If you go to a lawyer they require retainer fees of thousands of dollars upfront before they have done any work for you. When it comes to real estate, your Realtor is the “lawyer” of your real estate contracts. They must make sure everything is exactly as it should be in the contract and be able to defend it if necessary.

What is a CMA? Is it the best way to price my home?

A CMA is a Comparable Market Analysis. Realtors research everything they can about your property like the size, style, pros, cons, and neighborhood. Then they compile it all together to create a comp list of properties.

Comparable properties, aka comps, are those usually within 200 square feet of the listing house, within 10 years or the same architectural period as the listing house, and similar levels, lot sizes, and neighborhoods. A 3500 square foot, two-story colonial home on a lot in town is not comparable to a 1500 square foot ranch house on acreage. This is obvious.

But did you also know that your next-door neighbor’s Queen Anne Victorian 2800 sq ft home is not a comp to your 2200 sq ft Craftsman home? Even though they are in the same neighborhood and of the same quality, they are an apple and an orange. One is two or more stories while the other is one story with a basement. One is of a different era and style than the other.

When you are pricing your home, do not simply say well my neighbor sold his house for $750,000 so I should get that too when your houses are not similar. The house down the street might have a basketball court or a pool while yours does not. Your house may have even more amenities that can be highlighted when trying to fetch a higher price.

Listen to your Realtor when they recommend a price range. If they have done their homework, then they know where the price should land. You want to list perfectly right from the start so you get your home sold quickly. The longer a home sits on the market makes buyers and agents wonder what is wrong with the house that is just sitting on the market. Overpriced homes do that. Perfectly priced homes sell quickly. If you want or need more than what the market says then you may want to wait to sell when the market has higher prices.

Remember when you are pricing your home- would you want to pay more than a house is worth? Your house is only worth what the market says it's worth. Any more than that is overpricing, if you wouldn’t do it then why would you expect others to?

Your Realtor takes these general market stats, narrows them down to your neighborhood, then crunches the numbers to figure out the magical number that will help your house sell as quickly as possible. Every Realtor wants your house to sell within a week of listing- but this doesn’t always happen for a variety of reasons.

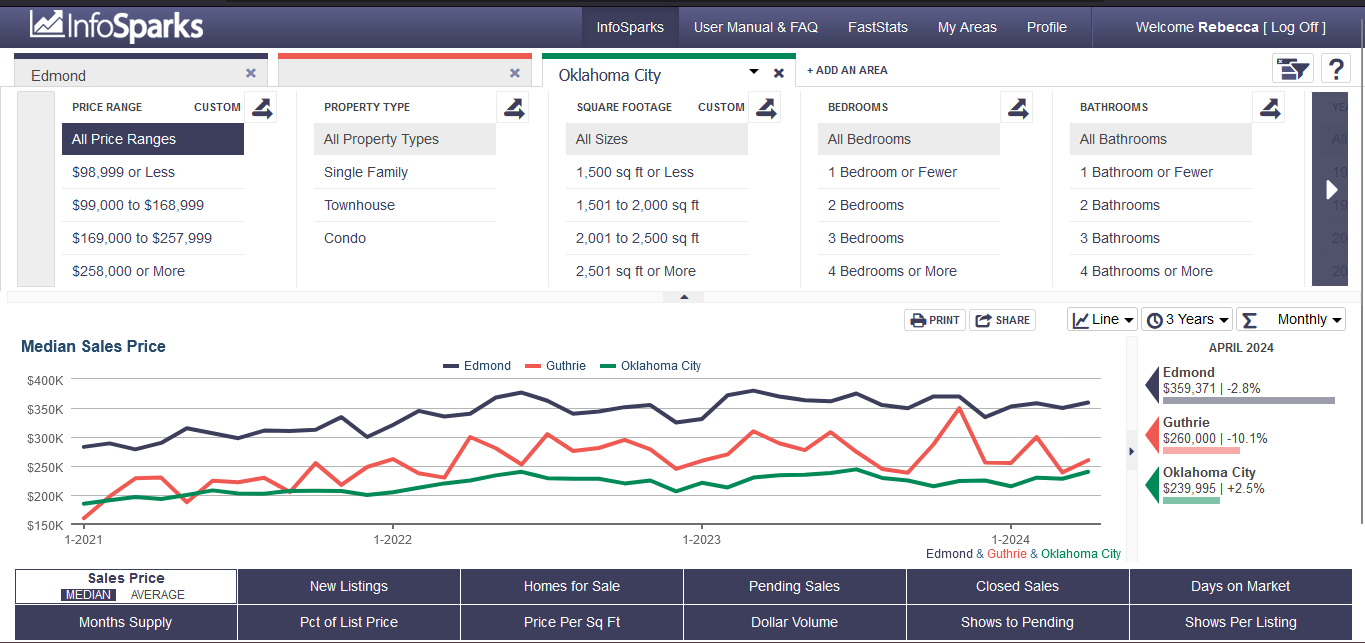

As you can see from the above data- each housing market is different than the other. Oklahoma City is difficult to even tell where it begins and ends as it makes its way past Edmond up to Deer Creek, yet the housing market is way below Edmond’s market. Guthrie is just a small town north of Edmond and while the housing market has been dropping in 2024, it has still increased from 2021. Housing prices fluctuate between markets and between months. Something else this data doesn’t tell you is that Guthrie has recently experienced a housing boom as developers buy up land and build new developments which floods the market with too many homes at once and decreases their overall value, but as those houses get sold and no more are built the housing market will stabilize again and stay more consistent. This stuff and a lot more are what your Realtor is spending their time doing at home and in the office- they want to make sure they price your house accurately. They don’t get paid unless your house sells. So believe me when I say you should listen to your Realtor when they price your house.

Ask to see their CMA and look it over with them so you are sure they did their job correctly too. They should not be pulling comps more than 90 days prior UNLESS your market is slow and there has not been enough sales in the last 90 days to create an accurate CMA- this can happen during winter months when less people are buying and selling houses. They should also be pulling homes within a reasonable amount of sq ft. The closer in square footage the better- there is a big difference between a 1200 sq ft house and a 3000 sq ft house- we never use the same price per square foot for houses this far apart in square footage- unless the market happens to be the same for both sizes- which is rare. The homes in the CMA should also be within 10-20 years of your build date and similar in style. We don’t run comparative market analysis on 1895 Queen Anne Victorians with a 2018 Modern Beach house. For that matter we wouldn’t even compare that same Victorian with a 1930s Craftsman home- even if they are in the same neighborhood. We compare apples to apples, not apples to oranges. Both are good, but they aren’t the same.

The Offers and Negotiation

So you’ve got your house on the market, your perfectly priced house, and now you’ve got multiple bids coming in after the warm and inviting open house your Realtor hosted this weekend. What do you do?

Waiting is not an option. In all real estate contracts, time is of the essence. It is written on the contract! Most offers come with a 48-hour acceptance clause or the buyers keep looking. They can rescind their offer within that first 48 hours as well if you haven’t accepted it yet. Until you accept in writing, there is no contract.

In a hot market, buyer agents will often make it a 24-hour acceptance clause.

Should you negotiate a better deal or accept one of the multiple offers?

Let’s look at three sample offers:

Your house is listed perfectly at $235,000 which is just under your neighbor’s house down the street at $237,000. The market is hot! Buyers flooded your open house. Now you have 5 offers sitting on your table. Which one do you choose? It's easy to reject the first two offers because they both came in under $200,000- lowballers? Insulting. Now that you are done being insulted you consider these 3 options:

1. An all-cash offer for $235,000 and will pay all closing costs for the buyer and the seller which is roughly 3% of the contract price extra for the sellers, but they won’t pay for the agent’s commissions. They also submit a bank statement showing they have the cash for the deal.

a. Buyers are paying $235,000 +$7,050= $242,050

2. An FHA loan offer for $233,000, will pay their agent and their closing costs while you pay your agent and your closing costs. Since you originally accounted for paying both sides of the commission, you can now give the entire 6% commission to your agent or you can renegotiate to pay them 3%- most will agree to this since they were not expecting to get the entire amount unless they were also the buyer’s agent. So now you have saved an unexpected 3%.

a. Buyers are paying $233,000 + $6990 (agent)= $239,990

3. A USDA loan offer for $245,000 but they want you, the seller, to pay all of the closing costs and the agent’s commissions. Since they are using a USDA loan they can finance up to 103% of the loan.

a. Buyers are paying $245,000 - $14,700 (your side of the agent & closing for them)= $230,300

As you can see the highest offer isn’t always the best deal. The other numbers matter! Now you can take the middle offer and be done because you see this will net you the most in the end.

However, if you are confident in your Realtor’s ability in the art of negotiation, you may want to try to counteroffer the third offer. You know they can take 103% which the 3% is to cover closing costs. You could try to negotiate with the buyers to cover $7350 with their loan proceeds at the closing table and ask their Realtor to take a reduced commission fee of 2% rather than the 3% originally offered. Those numbers would look like this: Buyers pay $245,000 - $4,900 (reduced agent commission)= $240,100. Will they agree to the counteroffer? Do you have time to get another under contract if they reject the counter?

Time is of the essence! Stipulate that you need an acceptance, counter, or rejection that falls before your acceptance is required on the other two contracts. Just remember that they could rescind their offers if another house they like better comes on the market or they just don’t want to wait for your answer. Is the extra money worth renegotiating? Those are all questions you must be ready to answer when the time comes. I had a transaction that had 4 counteroffers between the two parties before we got it under contract. Both parties knew what they wanted and were willing to compromise to get to the end goal- a new house for the buyers and a sold house for the sellers.

I am under contract, now what?

Once you have signed your chosen offer, you may start wondering what comes next. What happens over the next 30 days until closing? Many banks can close within 30 days, some need 45 days in super busy markets. Investors can close as quickly as the title company can, which in some cases may be as little as a week, some investors may take their time for the full 30 days. Either way, plan out your next month.

Both Realtors- the buyer’s agent and the seller’s agent will breathe again. They’ve done the hard work and now they are on to the mundane, stressful work. Realtors put in a lot of miles and unseen work in the background up to the point the house goes under contract. Now you will see the buyer’s agent more than your agent.

If you haven’t started packing yet- now is the time! Get as many belongings packed as possible. Only leave out what you must have to live for the next month- toiletries, linens, clothing, minimal cooking, and dishware.

First Step Towards Closing- Earnest Money

The buyers will drop off their Earnest Money at the agreed place- usually the Title Company for closing or the Broker’s Trust. This money is yours if the buyers break the contract outside of inspection, financing, title, or appraisal issues.

Second Step Towards Closing- Inspections

Coordinate with your Realtor for the Buyer’s house inspection to take place. They should coordinate with your schedule. You are allowed to be at the inspection or schedule while you are at work- the choice is yours. If you choose to be at the inspection you will learn a lot about your house that you probably didn’t know- the house inspection is the buyer’s property though- they don’t have to share it with you unless they ask for any Treatments, Repairs, or Replacements (TRRs).

Most of the time it is the buyer’s agent who is at the house inspection with the buyer, however, the seller’s agent may also be present if needed. Rest assured that your belongings are still being respected throughout the process- home inspectors do not want to have to call their insurance company to pay for claims against them-their premiums go up and they are required to have insurance to be licensed home inspectors.

The findings from the house inspection may require further inspections such as termite inspections if the house inspector finds evidence of damaged wood. They may recommend a structural engineer if they suspect structural issues- cracked foundations and walls may lead to this recommendation. Those inspections should also be performed promptly.

Once the buyers have made their TRR request in writing, you have the stated amount of days to have those completed. If you refuse to complete the requested treatment, repair, or replacements they have the right to rescind their contract and get back their earnest money.

You do not have to agree to all of the requests. Focus on the most expensive items and ask the repairman to bill to close if you don’t have the money upfront. Buyers will appreciate you covering those expensive items for them while they take care of the minor issues on their own.

Third Step Towards Closing: Appraisal

The appraisal is performed by a licensed appraiser. Sometimes homeowners schedule with the appraiser, while others never even know the appraisal has been completed. When appraisers can get a good picture of the interior of the house to know its condition from what the Realtor has posted on the MLS, they rarely will go into the home. They may come to check out the neighborhood and the exterior of the house if they are less familiar with the area. They may even do all of their work from the comfort of their home.

The bottom line is that the appraiser makes or breaks the deal- not the house inspector, which is a common misconception. The house inspector just finds the good, the bad, and the ugly. The appraiser decides if your house is worth what the buyer offered it. Going back to our scenarios earlier- if the house only appraises at $235,000 the only one who can even buy the house at this point is the cash buyer because FHA and USDA will not lend on homes that are not worth the amount they are lending. This is why it is so important to price according to the market. The appraiser is going to look at the last 6 months of market conditions when doing their analysis and research. They compare apples to apples.

They emerge with their number and that’s that. If the number is in your favor, then you are good to close. If the number is against you- the offer is too high- then you have to lower the price of the contract or else ask the buyers to pay more than it’s worth.

Most buyers will drop the contract before paying more than a house is worth. However, if you have a unique home that fits exactly what they want- they may find the money to pay the difference- then you are good to close again. If however, they don’t agree and you won’t lower the contract price, then you will have to find a new buyer- but they will be faced with the same issue- the house won’t appraise.

Your best bet is to lower the price to the appraised value so you can continue toward closing.

Moving Out

Moving day is looming. You know it's coming so why push it off to the last day? Don’t! You will regret it if you do. No one likes moving. It isn’t fun. If you have the money to hire professionals it is worth it. If you don’t have the money to hire professionals, then have a block party and invite friends and neighbors to help you pack and move, and in exchange you provide pizza and drinks.

Coordinate with the Realtors involved with the transaction. If the Buyer’s Agent is paying for a maid to clean your house on closing day (I do!) - then you won’t need to do that. If you need more time to move, communicate with the agents. The Buyer’s Agent can ask the Buyers to give you more time to move out past closing. They may agree, but they may not. So it's better to be prepared to move out by closing.

Communication is key to a successful closing and moving process. If your Realtor is coordinating your selling and buying of your next home transactions ask them to do a double closing on the same day. If you can close on your sold house, then turn around and close on your new house, you will move your belongings into your new house the same day- no storage needed, and no short-term rentals either! Win! Win!

Most truck rental companies let you keep the truck for a few days so you can just keep your belongings in the truck until closing.

The Closing

Whew! You’ve made it to closing day, now what?

Today you will meet with the Title Company which has been processing all of the paperwork to get your home purchase completed. They have been coordinating with your Realtor, the buyer’s Realtor, lawyers, the appraiser, the lenders, and others to make sure everything is good to go on closing day.

Many Realtors will take pictures of their clients holding a giant key(when buying) or a giant check (when selling) showing how much you got back when they sell your home. They do this for marketing purposes and to celebrate the occasion.

You can opt to have your funds wired to your bank account for a fee or the closing company can cut you a check at the closing table. Whichever you prefer, they will accommodate you. The title company will pay off your previous mortgage, if one exists, at the closing as well. They must do this to ensure a clear title goes to the new buyers.

Conclusion

When everyone does their jobs well, you don’t have to stress! Choose the right Realtor from the start, their team will guide you through the entire process and help you have an enjoyable experience. Contact us for more information on listing your home! We would love to partner with you on this exciting new adventure in your life.