Business Solutions

Dream it. Build it.

You dared to dream. You took the leap of faith and built something of your own. You pour your heart and energy into your business—working long hours, putting systems in place, and hoping to create the kind of financial stability that gives you peace of mind.

But if we’re honest, most business owners don’t feel that way. Too often, the reality is stress over cash flow, unexpected emergencies, and wondering how to protect both your livelihood and your legacy.

Secure it.

That’s where we come in. At The Blessed Ohana, we believe your business should support your dreams—not drain them. Just like family, we’re here to help you build a financial portfolio designed around your needs and goals. With smart solutions like IULs and annuities, we make sure you have access to cash when you need it most—whether that’s during an emergency, to fund growth, or to safeguard your retirement.

Because no one starts a business to fail. Yet, we’ve all seen it: a favorite coffee shop or boutique closed indefinitely, leaving the community heartbroken. We don’t want that to be your story- or your customers’ experience. With our business solutions, you can weather the down times, thrive through the good times, and pass on a lasting legacy to the next generation.

Get our Small Business Financial Guide today!

“Knowledge is power.”

🌻 Growth 🌻

🔐 Security 🔐

⛳ Retention ⛳

🌻 Growth 🌻 🔐 Security 🔐 ⛳ Retention ⛳

Annuities: Building Security for the Future

As a business owner, you’re always thinking ahead, so why not plan for the financial future of your business and your personal finances?

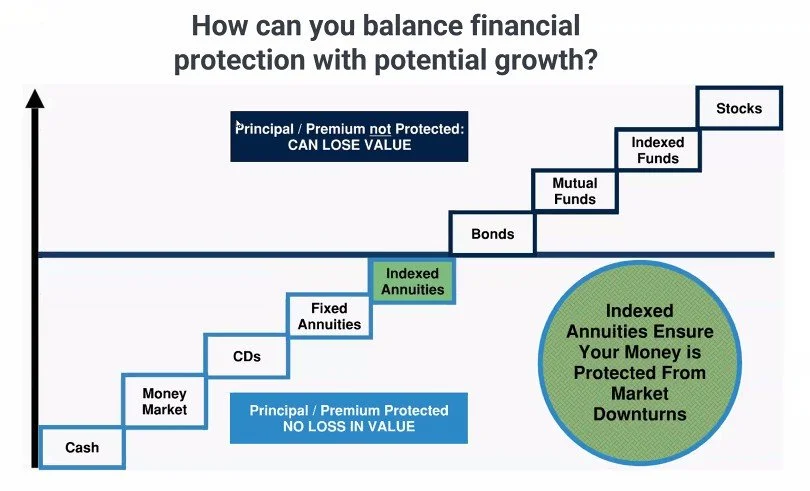

Annuities can be a powerful tool to grow and protect the money you’ve worked so hard to earn. With indexed annuities, your money grows steadily with the potential for higher returns than traditional savings options—without exposing you to the unnecessary risks that come with variable annuities.

A few of our carriers offer handsome bonuses that you don’t want to miss out on- one is as high as 13%, but these change over time, so don’t wait until later when you can do it now. Compounding interest works best when it has time + a good interest rate and even better with additional bonus money to help it grow.

Here’s how annuities can support your business and your people:

Fuel Future Growth

Annuities allow you to build a significant nest egg that you can tap into for expansion, new opportunities, or simply to give your business the financial cushion it needs to thrive long-term.Owner’s Pension Plan

You don’t need to rely solely on selling your business one day to retire. With an annuity, you can create your own retirement income stream—predictable, reliable, and secure. This allows you to pass your business on to your heirs without fear of your own income- build a legacy and grow generational wealth.Employee Retention & Care

Offering annuity-based pension plans for your employees not only helps them plan for their future but also shows that you, as an employer, care about their long-term well-being. This type of benefit strengthens loyalty, reduces turnover, and helps you attract top talent. Don’t have a large lump sum to invest in one of these for your employees? Don’t worry we have another solution for you! Read our IULs solution below.Peace of Mind

Indexed annuities give you protection from market downturns. Your principal is safe, your growth is steady, and your business’s financial foundation is stronger—so you can focus on what you do best.

At The Blessed Ohana, we design annuity solutions that align with your goals—whether you want to secure your personal retirement, provide meaningful benefits for your employees, or ensure your business has the strength to carry on for generations.

🌻 Growth 🌻

🔐 Security 🔐

⛳ Retention ⛳

🌻 Growth 🌻 🔐 Security 🔐 ⛳ Retention ⛳

The Financial Trinity:

Retirement, Cash Value, and Protection- All in One IUL Policy.

The Financial Trinity combines three powerful benefits into one: retirement income, cash value growth, and life protection.

Here’s why business owners love IULs:

Affordable Alternative to Annuities

Don’t have the lump sum to start an annuity for your employees? No problem. With an IUL, you can provide retirement benefits, cash value growth, and life insurance protection—all in one policy—without needing a large upfront investment.Retention & Loyalty

Offering IULs shows employees you care about their future. Whether you fund the policy or set it up for them to contribute (with the option to match a percentage—similar to a 401(k)), employees gain long-term security. Unlike a 401(k), though, retirement income from an IUL can be withdrawn tax-free when structured properly and won’t run out before they die like a 401(k) can.Cash Value Flexibility

IULs build tax-advantaged cash value over time. Employees (or even business owners themselves) can access this money for emergencies, business needs, or personal opportunities—without derailing their retirement.Protection for Family & Business

Beyond retirement savings, IULs provide a death benefit that ensures loved ones are protected if the unexpected happens. For business owners, this can also safeguard the company’s future and provide stability during challenging times.

At The Blessed Ohana, we help small businesses design IUL strategies that work for both the employer and employee. By combining protection, growth, and flexibility, IULs give your business the edge in retention while giving your team peace of mind for their future.