Ohana Solutions

Looking for our Family Financial Guide?

Imagine the possibilities!

Dare to Dream!

Imagine the possibilities! Dare to Dream!

At The Blessed Ohana, family is at the heart of everything we do.

Family First. Always.

Imagine…

the possibilities with generational wealth for your family.

“A society should be judged by how it treats its children. A country that fails to invest in its children is imperiling its future.”

“The failure to invest in youth reflects a lack of compassion and a colossal failure of common sense.”

“It is easier to build strong children than to repair broken men”

Give your child more than just a head start—give them a lifelong advantage.

Headstart Plans: A Legacy of Love & Financial Growth

Our Headstart Plans combine the protection of life insurance with the growth power of an Indexed Universal Life (IUL) policy. These plans build cash value over time, creating a flexible financial tool your child can use throughout their life.

Grows with them – Cash value builds year after year

Access anytime – Use it for college, a first car, a wedding, or even a home down payment

Lifelong protection – Lock in low rates and guaranteed coverage early

Teaches smart planning – Helps kids understand the value of saving, growing, and using money wisely

With a Headstart Plan, you’re planting seeds today for a future filled with options, freedom, and financial peace of mind. That’s the heart of the Blessed Ohana mission.

Protect what matters most- your family and financial future.

At Blessed Ohana, we’re dedicated to helping you protect what matters most—your family and your financial future. With a heart for community and a commitment to integrity, we provide personalized guidance to support your long-term financial wellness.

Life Insurance

From budget-friendly term policies to wealth-building Indexed Universal Life (IUL) plans, we help you choose coverage that fits your season of life and strengthens your family’s future.

Long-Term Care Planning

Life can be unpredictable. We help you prepare with coverage that protects your independence and lifts the burden from those you love.

Retirement Strategies with IULs & FIAs

Your retirement should feel as peaceful as an island sunset. We design strategies that use the tax-advantaged benefits of IULs and the stability of FIAs to create a flexible, reliable retirement income plan. Together, these tools can help you build wealth, preserve your savings, and enjoy financial freedom long into your golden years.

Headstart Plans for Children

Give the next generation a true financial head start. As these plans grow, children can access cash value for life’s big milestones—first cars, college costs, even their first home. It’s early security that builds lifelong financial independence and teaches the value of planning ahead.

Let’s talk about your goals and create a plan that brings you peace of mind today and financial confidence for tomorrow. We’re local, approachable, and here for our community—because with Blessed Ohana, you’re family.

What’s an IUL?

An IUL (Indexed Universal Life) is a type of permanent life insurance that provides a death benefit and builds cash value over time. The unique part? That cash value grows based on the performance of a stock market index like the S&P 500 (but without the risk of losing money when the market drops).

Upside potential, downside protection – You can earn market-linked returns with a built-in safety net: there’s a cap on how much you can earn, but also a floor, so your cash value won’t lose money in a downturn.

Flexible & powerful – You can adjust your premiums and death benefit as your needs change.

Tax-advantaged growth – Your money grows tax-deferred and can be accessed tax-free in retirement.

No bank loans needed – Borrow from your own policy without penalties or qualifying. It’s your money—use it when you need it. No need to wait til you are 59 1/2 to use your money- if your account has cash value, you can use it whenever you need to, tax-free, risk-free- if you don’t pay it back, upon your death, the death benefit is reduced by the amount you borrowed- it’s really that simple.

With an IUL, you're not just protecting your loved ones—you're building a financial legacy that grows with you. That’s the Blessed Ohana way.

What’s Term Life Insurance?

Term life is simple, affordable protection for a set period—like 10, 20, or 30 years. If something happens to you during that time, your loved ones receive a guaranteed payout to help cover expenses and keep life going. You wouldn’t jump out of a plane without a parachute- so why would you do life without the safety net of life insurance?

Budget-friendly – Lower premiums than permanent policies, young adults often get over $100K in coverage for less than $20 a month or $1M for less than $60 a month! The wisest decision you’ll ever make is protecting your family for less than a tank of gas each month or date night at the movies, respectively.

High coverage when you need it most – Great for young families, new homeowners, or anyone with big responsibilities

Covers temporary needs – Like income replacement, mortgage protection, or education costs

While it doesn’t build cash value, term life offers powerful peace of mind during life’s busiest seasons. Protect your ohana without breaking the bank.

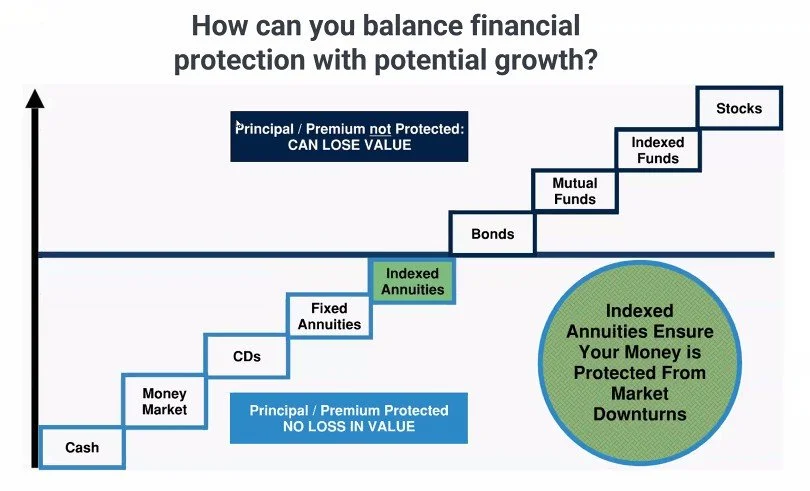

What’s an Indexed Annuity?

An indexed annuity helps you grow and protect your retirement savings—all without risking your principal.

Market-linked growth – Earn returns based on a stock market index (like the S&P 500), but with built-in protection so you never lose your initial investment

Steady retirement income – Many annuities offer guaranteed lifetime income you can’t outlive

Wealth preservation – Great for those who want to grow their money while keeping it safe from market dips

At The Broker Group and Blessed Ohana, we help you decide if this strategy fits your goals—so you can retire with peace of mind and aloha.

What’s Long-Term Care Insurance?

Long-Term Care (LTC) Insurance helps pay for care when you need extra help with everyday tasks—like bathing, dressing, or eating—whether at home, in assisted living, or a nursing facility.

Covers what health insurance doesn’t – Protects against out-of-pocket costs not covered by Medicare or Medicaid

Preserves your savings – Helps protect your assets from being drained by long-term care expenses

Gives you options – Choose where and how you receive care

Eases the burden – Reduces stress on your loved ones during difficult times

Planning for your long-term care needs means you stay in control—and your family stays supported.

That’s peace of mind, the Blessed Ohana way.

Living Benefits: Coverage When You Need It Most

Indexed Universal Life (IUL) policies don’t just protect your loved ones after you're gone—they can support you while you're still living. That’s the heart of Living Benefits.

Many IULs include Accelerated Death Benefits (ADB) at no extra cost, allowing you to tap into your policy early if you face a major health challenge.

What’s Covered?

Chronic Illness – If you can’t perform 2 out of 6 daily living activities (like bathing or eating) or need supervision for cognitive issues

Critical Illness – Includes serious conditions like heart attack, stroke, cancer, or major organ failure

Terminal Illness – If you're diagnosed with a life expectancy of 12–24 months (varies by state)

These benefits can help cover care, ease financial pressure, or simply give you peace of mind during a tough time.

Accessing Cash Value

In addition to living benefits, your IUL builds cash value that grows over time—tax-deferred and linked to a market index. You can borrow against this cash value anytime for any reason—whether it’s to cover emergencies, fund a dream vacation, pay off debt, or supplement retirement. No loan application, no credit check—it’s your money, growing and available when you need it.