Indexed Annuities: The Goldilocks of Retirement Plans?

Let’s face it—retirement planning can feel like trying to assemble IKEA furniture without the manual. There are 401(k)s, IRAs, mutual funds, annuities, oh my! And right when you think you’ve got it figured out, someone throws around a term like indexed annuity, and you’re flummoxed.

Fear not! If you're looking for a way to grow your money with less risk than the stock market, but more potential than a savings account, then indexed annuities might just be your financial fairy tale. Let’s break it down.

So… What Is an Indexed Annuity?

Imagine a hybrid between a savings account and a stock market investment. An indexed annuity is a type of insurance product that allows your money to grow based on the performance of a stock market index—most commonly the S&P 500.

Here’s the kicker: your money isn’t actually in the stock market. It’s just linked to it. So if the market does well, you get some of the gains. If it tanks? You’re protected. Think of it as enjoying the thrill of the roller coaster… from the safety of the kiddie ride next door.

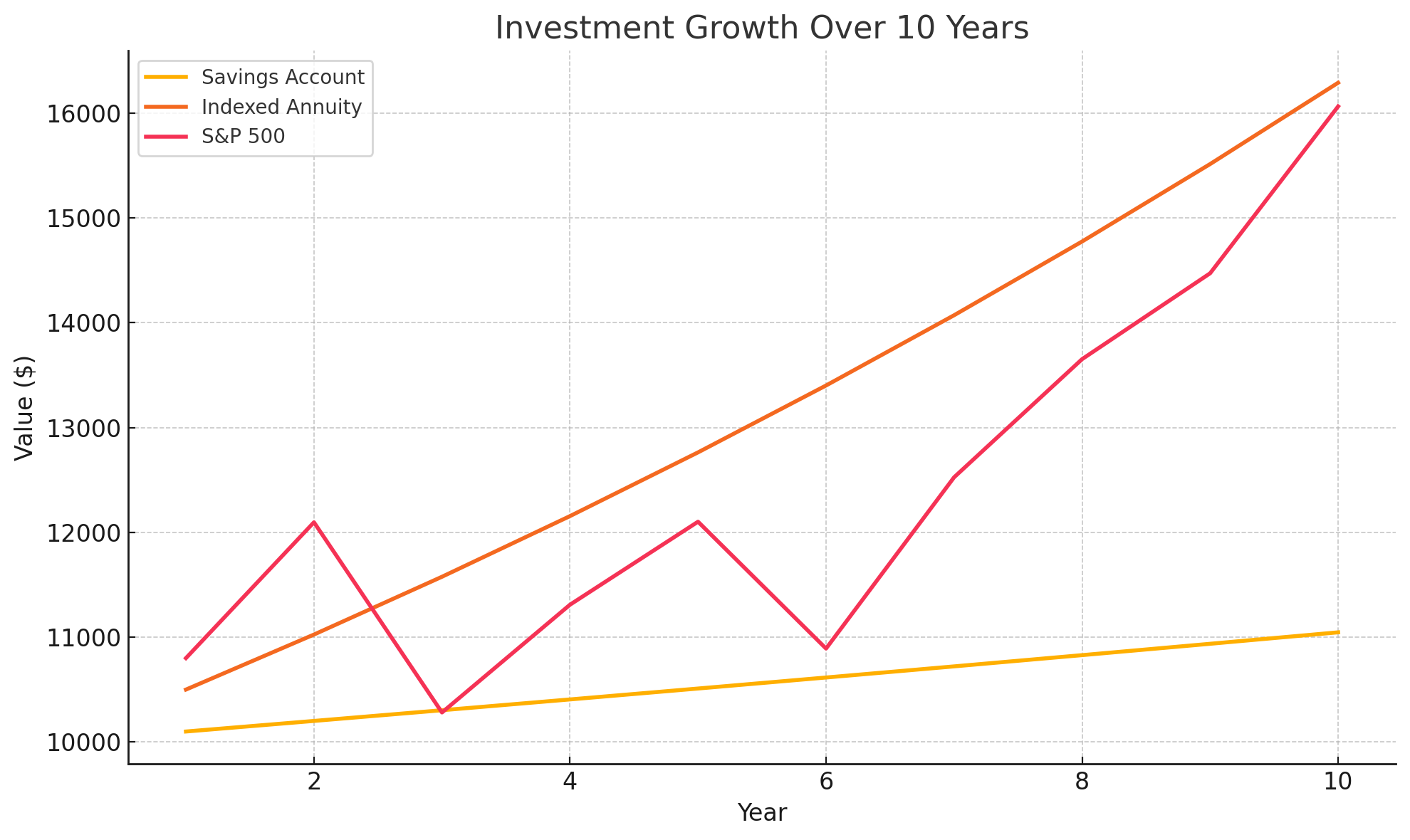

Annuities vs S&P 500 vs Savings

For illustrative purposes only.

Why Would Anyone Want One?

Glad you asked. Here are a few reasons people are cozying up to indexed annuities like it’s sweater weather:

1. Protection from Losses

Your principal is protected. That means if the market has a meltdown, your account won’t lose value due to the market dip. (You may not gain anything that year, but you won't go backwards either.)

2. Tax-Deferred Growth

The money inside grows tax-deferred. Translation: you don’t pay taxes on earnings until you withdraw. So you get to keep more of your money working for you longer.

3. Potential for Better Returns than a CD or Fixed Annuity

Because it’s tied to a market index, you could earn more over time than traditional fixed interest products. But…

4. There’s a Cap or Participation Rate

You don’t get all the market’s gains. The insurer usually puts a cap (say, 7%) or gives you a percentage of the growth (like 80%). So if the index goes up 10%, you might get 7% or 8%. Still, not too shabby compared to 0.5% in a savings account.

5. Retirement Income for Life

When you're ready, you can turn that money into guaranteed income you can't outlive. It’s like giving yourself a paycheck in retirement—even if your investment technically runs out.

The Fine Print: What to Watch For

Indexed annuities aren’t all rainbows and ROI. Here are a few things to keep in mind:

Surrender Charges: If you take your money out too early (usually within 5–10 years), you might pay a penalty.

Complex Terms: Some contracts are about as easy to read as your car's warranty. (Translation: Get help or a second opinion.)

Limited Liquidity: These aren’t ideal for short-term needs or quick cash access.

Who Should Consider an Indexed Annuity?

You’re approaching retirement and want to protect your nest egg, but still have growth potential.

You’ve maxed out your 401(k) and IRA and want another way to save for retirement or you want to rollover your 401(k) or IRA into an indexed annuity to allow it to grow at a much better rate.

You like the idea of a guaranteed retirement paycheck, especially if you don’t have a pension.

You’re risk-averse, but still want to beat inflation.

Bottom Line

An indexed annuity isn’t the right choice for everyone, but for many, it can be a great “Goldilocks” solution. Not too risky, not too boring—just right.

Think of it as the financial equivalent of a hybrid car: safe, efficient, and a little smarter than it looks.

So if you’re feeling overwhelmed with options for your future, don’t sleep on indexed annuities. They might just be the steady, smart sidekick you need on your journey to a well-funded retirement.

Want to find out if an indexed annuity is right for your financial fairy tale?

Let’s Talk! Schedule a meet & greet with me today!