The Retirement Myth That Costs Families Thousands

Most families believe, “If I just max out my 401(k), I’ll be fine.”

It sounds responsible.

It sounds safe.

It sounds like what everyone is supposed to do.

But here’s the truth…

For many families, this belief quietly costs tens — even hundreds — of thousands of dollars over a lifetime.

Let’s talk about why.

Myth #1: A 401(k) or a 403(b) Is a Retirement Plan

401(k)s and 403(b)s are not retirement plans. They are accumulation vehicles. That’s it.

They help you:

Defer taxes today

Invest in the market

Build a lump sum

But they do not guarantee:

Continued growth after retirement

Protection from market crashes

Guaranteed lifetime income

A pension-style paycheck

When you retire, you now face three big risks:

Market risk (What if it drops 30%?)

Longevity risk (What if you live to 95?)

Protect

✝️

Prosper

🌺

Pass it on

❤️

Protect ✝️ Prosper 🌺 Pass it on ❤️

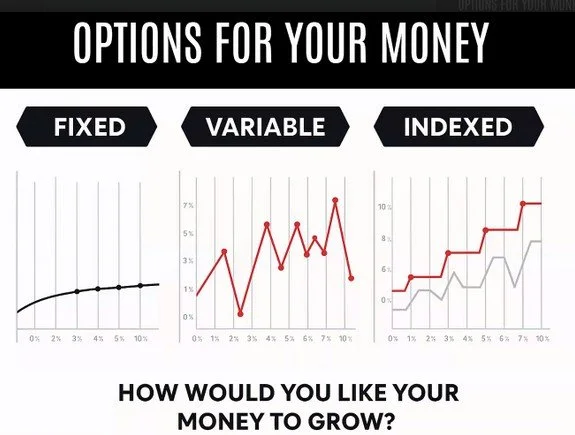

Options for Growing Money

Fixed accounts like savings, money market accounts, and CDs grow slowly but steady. Variable accounts like stocks, bonds, mutual funds have high volatility- they can grow super high and also lose everything invested. Indexed accounts grow (with caps) with the stock market, but never lose money when the market goes down- they are safer than the stock market while growing better than savings.

What Most Financial Institutions Don’t Emphasize

Your 401(k) was designed for accumulation years, not retirement years.

When you retire, many advisors quietly recommend something else:

➡️ Moving those funds into an Indexed Annuity.

Why?

Because indexed annuities can provide:

Principal protection

Growth tied to a market index (without direct market loss)

Guaranteed lifetime income (a pension-style paycheck)

Predictable retirement cash flow

In other words:

Accumulation first. Protection and income are second.

The problem?

Most people don’t learn about this transition strategy until they’re within a few years of retirement — and by then, valuable time has been lost, fees and taxes have been paid, and usually hundreds of thousands of dollars are gone that will not be reclaimed. An annuity or a properly structured IUL prevents this from happening- instead, you get tax-free retirement, much lower fees than the 401(k), along with long-term care benefits and death benefits.

The Second Costly Myth:

“I’ll Worry About Retirement in My 40s or 50s.”

This one hurts the most.

Waiting costs families in three major ways:

1. Lost Compound Growth

Time is more powerful than contribution size.

Starting at 25 vs. 45 can mean:

Investing far less

Ending up with far more

2. Higher Insurance Costs

Life insurance premiums go up as you age and risk of death increases. Why not lock in those low premiums now while you are young and healthy? Waiting til the time is right means:

Higher premiums

Lower leverage

More medical risk

Every day, you are one step closer to death- that is reality. Why not have the only insurance guaranteed to pay out to either you or your loved ones?

3. Fewer Strategic Options

The earlier you build cash value, the more flexibility you have later.

When families wait, they lose opportunities for strategic layering. A young family who starts headstart plans for their young children might put in $50 to $100 a month and later never has to worry about paying for college, weddings, or down payments on first houses because they wisely invested from the beginning and can pull cash out and use it as needed, meanwhile their money continues growing steadily in the account- this is done through what is known as a “wash loan”. Don’t worry if this sounds complex- we can guide you every step of the way.

The Overlooked Strategy:

Using IUL Cash Value for Strategic Accumulation

An IUL is not just a death benefit policy.

When structured properly, it can:

Build tax-advantaged cash value

Provide downside protection

Offer tax-free income potential

Create liquidity before retirement

Here’s where it gets interesting…

Some families use their IUL cash value strategically to:

Supplement retirement income

Bridge early retirement years

Or even position funds into an indexed annuity later for guaranteed lifetime income

This creates layers:

Tax diversification

Market protection

Income guarantees

Legacy planning

It’s not about replacing everything.

It’s about designing a smarter financial portfolio that creates generational wealth- even if you aren’t wealthy.

What We See Over and Over

Most families have:

A 401(k)

Maybe a small Roth

No pension

No guaranteed lifetime income

No tax diversification plan

And they assume they’re “on track.”

But when we run comparisons, the differences can be eye-opening.

See the Difference for Yourself

This is where clarity replaces guesswork.

In a private strategy session, we can:

Compare your current 401(k) or 403(b) to a new structured account

Model long-term projections

Show potential outcomes using an IUL strategy

Illustrate what guaranteed lifetime income could look like through an indexed annuity

Demonstrate tax impact differences

Bridge the gap between reality and dreams

We use professional planning software to show real numbers — not opinions.

No pressure. No obligation. Just education.

The Real Retirement Plan

A true retirement strategy should include:

Accumulation

Protection

Tax diversification

Guaranteed income

Legacy planning

If your current plan only checks one of those boxes, you may be leaving money — and peace of mind — on the table.

Ready to See What’s Possible?

Book a complimentary Retirement Clarity Session.

Let’s look at your current plan side by side with alternative strategies and see what truly aligns with your goals.

Because retirement shouldn’t be a gamble, it should feel steady, predictable, secure, and fully aligned with the life you’re building.