Guaranteed Lifetime Income: The Smart Way to Retire Confidently

Your Retirement Security Blueprint — Blessed Ohana Style

Retirement should be a time of joy, freedom, and connection—a season to travel, give back, and cherish time with family. But for many retirees, a shadow lingers over that dream: the fear of outliving your money.

At Blessed Ohana, we believe retirement should feel like peace of mind, not pressure. Yet, as Americans live longer and the old system of pensions fades away, many are left navigating the uncertain seas of 401(k)s, IRAs, and volatile markets. This is what we call longevity risk—the possibility of living so long that your savings run dry.

The good news? You don’t have to face that risk alone. There’s a proven way to secure a guaranteed lifetime income, one that keeps paying you no matter how long you live: annuities.

What Exactly Is an Annuity?

Think of an annuity as your retirement paycheck for life—a partnership between you and an insurance company. You contribute a lump sum or a series of payments, and in return, the insurer promises to provide you a steady stream of income, often for as long as you live.

In essence, it’s a simple exchange: your savings for security, your uncertainty for peace.

The Top 3 Benefits of Using an Annuity

At Blessed Ohana, we often recommend Fixed Index Annuities (FIAs) with income riders for our clients who want both growth potential and protection. Here’s why:

1. A Lifetime Paycheck You Can’t Outlive

This is the heart of annuity power. Through a Guaranteed Lifetime Withdrawal Benefit (GLWB) rider, your income is locked in for life—no matter what the market does.

🌴 Peace of Mind: Your essential monthly expenses (like housing, groceries, and healthcare) are covered by your guaranteed income.

🌺 Unshakable Stability: Even if the market crashes or your annuity’s cash value reaches zero, your payments continue for as long as you live.

That’s financial freedom.

2. Protection from Market Loss

If you’ve ever watched the market drop and felt your stomach turn, this benefit will make you breathe easier.

🌴 Principal Protection: With FIAs, your money is linked to a market index (like the S&P 500) but never directly invested in it.

🌺 Zero Is Your Hero: If the market dips, you don’t lose a penny—your annuity earns 0% for that period. When the market recovers, your gains are locked in, never lost.

That means your nest egg is shielded, not shaken.

3. Tax-Deferred Growth

Your money deserves to grow without unnecessary tax drag.

🌴 No Annual Taxes: You only pay taxes when you begin withdrawals, allowing your savings to grow faster through compounding.

🌺 More Growth, Less Stress: Over time, this can create a larger income pool for your retirement years.

Annuities help your money work smarter, not harder.

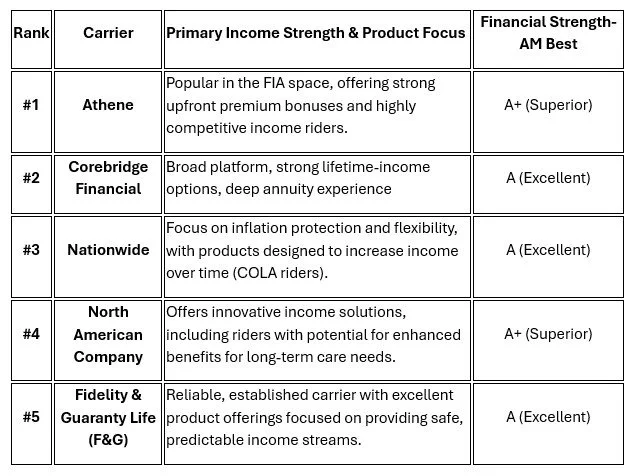

Choosing Your Income Partner: Top 5 Annuity Carriers We Trust

When you purchase an annuity, you’re forming a long-term partnership. That’s why we only work with carriers that have proven financial strength, integrity, and a long history of keeping their promises.

Here are five of the carriers we trust and recommend to our clients:

Conclusion: Securing Your Future with Confidence

Annuities are a vital tool in the modern retirement toolbox, specifically designed to eliminate the anxiety of outliving your money. They allow you to shift the risk of longevity and market downturns away from your personal savings and onto a financially strong insurance carrier.

While this "Top 5" list is a great starting point, the right annuity for you depends entirely on your unique goals, age, timeline, and family needs.

Ready to See Your Guaranteed Income?

Don't leave your financial security to chance. As a Licensed Financial Professional specializing in retirement income strategies (including IULs and annuities), I can provide a free, personalized income projection.

We will analyze your situation and show you exactly how much guaranteed lifetime income an annuity can generate for you.