Things Everyone Knows, But Few People Acknowledge

100% of people die!

Yep! That’s right! Everyone dies- even Methuseleh died at 969 years old- the oldest man ever recorded on Earth still had to consider what he was leaving to his heirs.

Proverbs 13:22 “A wise man leaves an inheritance to his children's children.” Even during old testament times the people were thinking about generational wealth. Can you imagine how different your life might be had your grandparents left a huge inheritance to you and that was left by their grandparents and so on- you might even have Walton kind of money- Sam Walton was thinking about his children, legacy, and the people of America when he created Wal Mart. What kind of legacy do you hope to leave behind when you go? What will you leave your children and grandchildren?

51% of American adults have life insurance- which means 49% have no plan for what happens when they die.

Do you have life insurance? If not, then you should because death is expensive to those you leave behind.

Do you have enough life insurance? At the bare minimum you should have enough to cover the average funeral- call your local funeral home and they will happily share with you the average price of a funeral.

My dad carried just enough to cover his funeral but not enough for a burial plot. My parents, like most Americans, believe they have time to get all that sorted out. They put things off until retirement, but things didn’t work out the way they planned.

My dad gave his best years to his career, caring for his property, and taking care of his family. Then at age 60 he died of stage 4 cancer. He had been seeing doctors regularly for some other issues and they had failed to diagnose his cancer until 2 months before he died.

To keep costs down, my mother rented his casket, opted for cremation because it saved thousands, chose a patriotic urn, and held a small, intimate funeral for him. The cost? Just under $7,000- remember that didn’t even include him being buried in the casket or a burial plot. Yikes!

Having something is better than nothing! Young adults can get term policies for as little as $10 a month, while older adults closer to retirement can get them for $20 a month so there really is no excuse to have no insurance.

How much do I need?

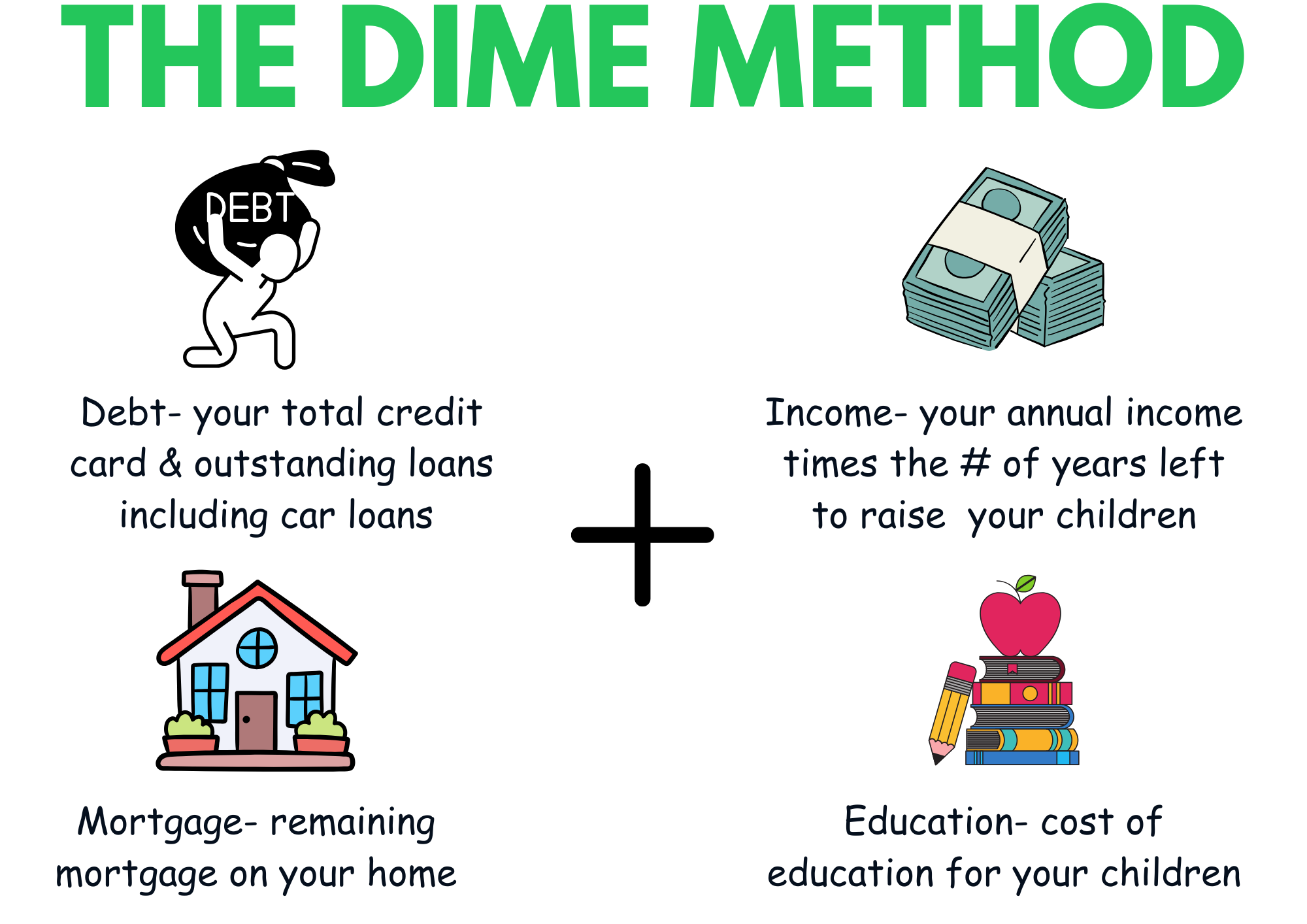

To calculate your needs use the DIME method:

DIME

Debt + Income (x10) + Mortgage + Education=

The total amount of life insurance to provide for your family upon your untimely demise.

For Example:

Debt- car loan $35K, credit card $2k= $37,000

Income- $45K per year x 18 years (youngest is a newborn)= $810,000

Mortgage- $300K owed on new home for family of 4

Education- estimate $40K per year for 2 children ($20K each) to attend 4-year university $160K

Total amount needed= $1,307,000 + funeral & burial expenses

An illustration for term insurance

For illustrative purposes (rates vary by individual)

A healthy 25-year-old male could qualify for $1.5 million in life insurance for $75 a month for 20 years

This means you pay a total of $18,000 over 20 years, but your family receives $1.5 million if you die.

While this is good for temporary coverage, if you outlive your policy you are back to square one- which is why an IUL makes more sense when you are younger and healthier- good coverage for life at a lower cost than if you start one when you are older.

A healthy 30-year-old male could qualify for $1.5 million for $92 a month for 20 years, again same thing as the above situation, but you’ve paid in just over $22K over that 20 year period.

A healthy 45-year-old male could qualify for $1.5 million for $227 a month for 20 years or reduce to 10 years for $167 a month, but they will have paid in over $54K for 20 years or just over $20K for 10 years- quite a bit if there is no return on that investment. In this case, personally, I would never recommend this person get a term policy as this would only last them until they are 55 to 65 years and then it would be difficult to qualify for something permanent and it would cost them quite a bit more. Despite what the so-called financial gurus say, most people don’t have $10K to cover a funeral in their estate unless items are sold off. Instead an IUL will do the job while also giving the client access to the cash value to use as their piggy bank while still providing a death benefit.

I think the financial gurus that people have been taking advice from think the general population is too ignorant to realize they can understand what an IUL is and don’t need term insurance because “its simple and easy” and “has one job to do and does it well”- which is untrue- if you don’t die inside the term years then it never does its job- it just gives him a big payout and you get nothing.

But if you do nothing and take the risk of being uninsured and you die unexpectedly tomorrow of 5 years from now- will your family be able to get by without you? Unless you can predict the future- you need at the bare minimum, term life insurance.

Is this why?

〰️

Get insured while you are young!

〰️

Is this why? 〰️ Get insured while you are young! 〰️

Over 125,000 people each year beg for money on GoFundMe to have their loved ones’ memorial services covered

Do you really want your loved ones to beg for money from strangers to cover the cost of your funeral?

Ask yourself- “If (my mom, my spouse, my child) died today, could I afford a funeral or even just cremation?”

The lowest cost of cremation that we’ve found online is $695, and that is the worst thing you can do for your family!

The first time we had to have a family member cremated. it cost us out of pocket $500, because someone sold her an end-of-life policy that was only $1000. What we got for that $1500 was her ashes in a big plastic bag. There were even bone fragments in the bag! Imagine our shock at seeing my best friend’s mother in such a state! It was horrifying to say the least.

Please don’t put your family through this shock! Plan ahead. Rarely does anyone know the date of their death. My best friend’s mom went in for a routine procedure and died on the surgery table in her 50s. My dad died at 60 from cancer that had only been diagnosed 2 months prior. Meanwhile my grandmother lived a good long life until she was 90 years old- yet still it was unexpected because she seemed healthy and then suddenly got sepsis and died.

So when I share in our ads that death comes for everyone and its often unexpected- I am speaking from experience. It is not a scare tactic!

A few more tragedies we’ve experienced- all had no life insurance- a 12-year-old cousin died in a tragic car accident, a healthy aunt who was a nurse died in her 50s from a heart attack, a best friend, who was also a nurse, died of colon cancer in her early 30s, a beloved great aunt in her 60s pianist and professor died from being trapped by flood waters, another grandmother who fell and caused a blood clot to go straight to her heart, I could go on but I’m sure you get the point- Death comes unexpectedly and suddenly and we are woefully unprepared for it.

Sadly, America lost a great conservative Christian man, Charlie Kirk, and other than those who took his life, I don’t think anyone could have predicted that he would leave this earth at just 31 years old, leaving behind a wife and two young children.

Death is imminent!

We know we will die at some point- so why not prepare for it?

2 Things We All Need to Prepare for the Afterlife

Anyone out there follow Devin Gibson? He is “gooder than chicken”. He has the best thing we need to prepare for death and life- The Bible or as he calls it “Basic Instructions Before Leaving Earth”.

The Holy BIBLE: Basic Instructions Before Leaving Earth

So the second thing we all need to prepare for the afterlife is life insurance.

A wise man prepares for what he knows is coming. Noah was told the flood was coming so he built the ark. You know that death is coming, so get life insurance. Noah had God to tell him how to build the ark. You have us at TheBlessedOhana.life or anyone else you trust to guide you through the process of acquiring life insurance.

Which type do I need to get? Why are there so many options?

You know how Bibles come in many translations? I personally prefer the New American Standard (NASB) while my grandpa, mom, and oldest son prefer the King James version, and my two youngest children read the NIV.

Like versions of the Bible, there are many types of life insurance. Knowing which type is best for you is why it’s a good idea to have a licensed life insurance agent helping you.

Captive life insurance agents will only sell you one kind- their company’s policy. So, like a State Farm agent will only offer you State Farm life insurance. An Allstate agent will only offer you Allstate life insurance.

We at The Blessed Ohana and The Broker Group are non-captive, meaning we work with many different carriers to match the perfect products to our clients. We only work with top A-rated companies as well- this ensures safety and longevity for your policy.

There are 3 different types of life insurance:

Term life insurance- temporary life insurance that is typically low-cost, high death benefit, but has nothing else attached to it and only pays out if you die within the term limit.

Whole life insurance- permanent life insurance, as long as you pay the premium.

IUL (Indexed Universal Life) insurance- permanent life insurance, that grows cash value, if you have cash value accumulated (occurs after the 1st year typically) and you cannot make a payment then the policy is paid for through the cash value and only ceases if the cash value depletes, the cash value can also be accessed for personal use, plus you still have your death benefit.

Each has a purpose, but in our humble opinion, IUL makes the most sense in most people’s cases because it grows a nest egg for retirement safely, tax-free, and risk-free. But they cost a bit more monthly to maintain than term life.

If you cannot afford much, then term life is the way to go. With policies starting as low as $10 a month, it’s easy for everyone to be covered- no need to beg for money on GoFundMe anymore- no excuses!

Two of the carriers we work with- Ethos & Foresters- both have more leniency when it comes to health issues so they will insure you for term and whole life when others won’t- including COPD, heart attacks, and diabetes.

The fact that we can shop around for you makes us the perfect agency to work with- plus when you call our agency- you get to talk to your agent- not some rando you’ve never met nor talked to or a computer asking you to choose an option and be connected. We believe in genuine connections and our clients becoming a part of our blessed Ohana.